The smart Trick of Pacific Prime That Nobody is Discussing

Insurance policy likewise aids cover costs linked with liability (legal responsibility) for damages or injury created to a 3rd party. Insurance policy is an agreement (policy) in which an insurer compensates an additional against losses from certain contingencies or hazards. There are lots of sorts of insurance policy policies. Life, wellness, homeowners, and vehicle are among one of the most common forms of insurance.

Investopedia/ Daniel Fishel Lots of insurance coverage policy types are offered, and essentially any type of specific or organization can discover an insurance provider happy to insure themfor a price. Typical individual insurance coverage kinds are vehicle, health, house owners, and life insurance coverage. A lot of individuals in the United States have at least among these sorts of insurance, and automobile insurance policy is called for by state law.

Not known Details About Pacific Prime

Discovering the price that is best for you needs some legwork. Maximums may be established per duration (e.g., annual or policy term), per loss or injury, or over the life of the plan, additionally recognized as the life time optimum.

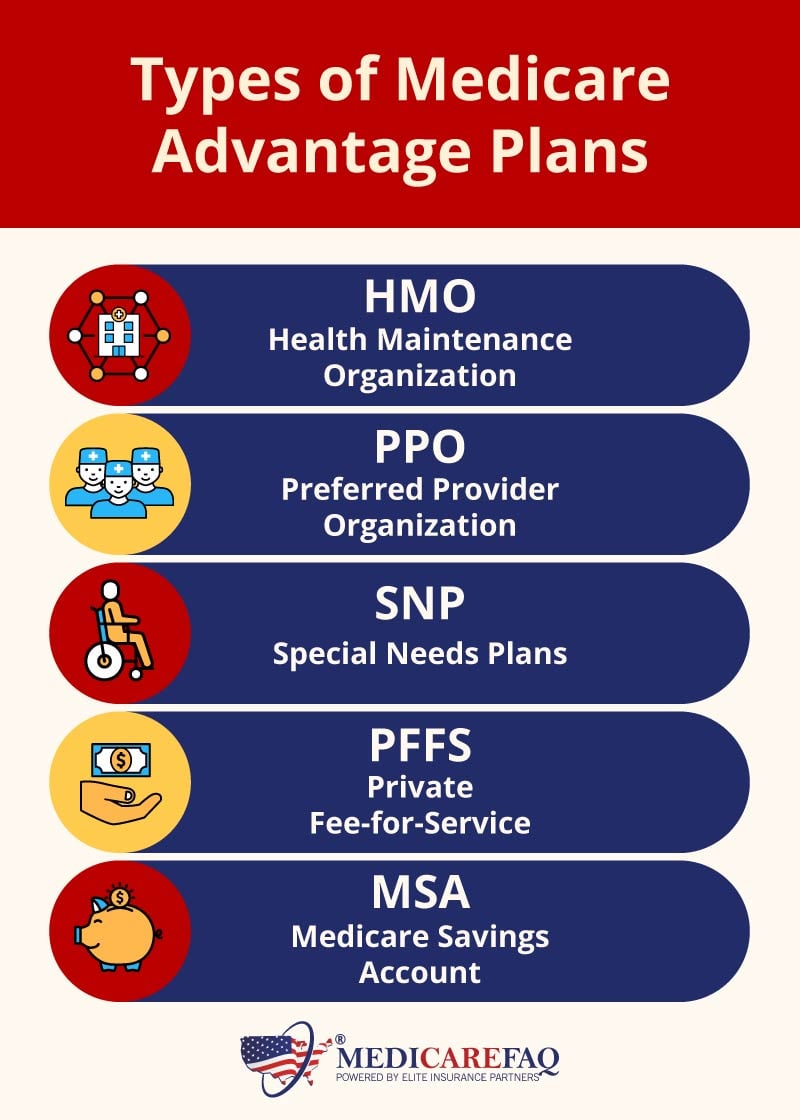

Plans with high deductibles are commonly more economical because the high out-of-pocket expenditure generally leads to fewer small claims. There are several sorts of insurance coverage. Allow's consider the most important. Health insurance policy helps covers regular and emergency medical care prices, typically with the alternative to add vision and dental solutions individually.

Lots of preventive services might be covered for cost-free before these are satisfied. Health and wellness insurance may be purchased from an insurance business, an insurance policy representative, the federal Health Insurance coverage Marketplace, provided by a company, or federal Medicare and Medicaid coverage.

How Pacific Prime can Save You Time, Stress, and Money.

Rather of paying of pocket for vehicle mishaps and damage, individuals pay annual costs to a car insurer. The business then pays all or a lot of the covered prices connected with a vehicle mishap or various other car damages. If you have a rented lorry or obtained money to get a cars and truck, your lending institution or renting dealership will likely need you to carry auto insurance coverage.

A life insurance policy policy assurances that the insurer pays an amount of cash to your recipients (such as a spouse or kids) if you pass away. In exchange, you pay costs throughout your lifetime. There are two main kinds of life insurance policy. Term life insurance policy covers you for a certain duration, such as 10 to twenty years.

Insurance policy is a way to manage your monetary risks. When you acquire insurance coverage, you purchase security against unanticipated economic losses.

The Best Strategy To Use For Pacific Prime

There are several insurance coverage policy kinds, some of the most usual are life, health, homeowners, and vehicle. The ideal kind of insurance policy for you will rely on your objectives and financial scenario.

Have you ever before had a moment while taking a look at your insurance coverage or buying insurance coverage when you've thought, "What is insurance coverage? And do I really need it?" You're not the only one. Insurance can be a mystical and puzzling point. How does insurance policy job? What are the advantages look at here of insurance policy? And how do you locate the most effective insurance policy for you? These prevail inquiries, and thankfully, there are some easy-to-understand solutions for them.

Experiencing a loss without insurance coverage can put you in a challenging financial scenario. Insurance policy is an essential economic device.

All About Pacific Prime

And in many cases, like automobile insurance coverage and workers' settlement, you might be required by regulation to have insurance coverage in order to safeguard others - maternity insurance for expats. Find out about ourInsurance choices Insurance is basically a massive nest egg shared by lots of people (called insurance policy holders) and handled by an insurance policy provider. The insurer utilizes money gathered (called premium) from its insurance holders and other financial investments to spend for its operations and to satisfy its assurance to insurance policy holders when they file an insurance claim

:max_bytes(150000):strip_icc()/terms_i_insurance_FINAL_-3556393b3bbf483e9bc8ad9b707641e4.jpg)